Bronx County Property Appraiser

ACRIS

The Automated City Register Information System (ACRIS) allows you to search property records and view document images for Manhattan, Queens, Bronx, and Brooklyn from 1966 to the present. With ACRIS, you can: Due to system maintenance, ACRIS eCheck Payments will be unavailable on Wednesday, January 21, 2026 from 7:30pm to 9:30pm (EST).

https://www.nyc.gov/site/finance/property/acris.page

Abode Money Bronx County, NY Property Tax Appeal Guide (2026)

Want to lower your property taxes in Bronx, NY? Use Abode Money to lower property taxes in just a few steps. Follow this proven step-by-step process to successfully challenge your Bronx County property assessment through the NYC Tax Commission and potentially save thousands on your property tax bill.

https://www.abodemoney.com/property-tax-guides/bronx-county-ny-property-tax-appeal-guide-2026

TOP 10 BEST Real Estate Appraiser in Bronx, NY

... Real Estate Appraiser" results near me in Bronx, New York - January 2026. Showing 1-60 of 234. Harris Appraisals 1 - Real Estate Appraiser near me - Bronx, New ...

https://www.yelp.com/search?find_desc=Real+Estate+Appraiser&find_loc=Bronx%2C+NYBronx County, NY Property Tax Calculator 2025-2026

Calculate Your Bronx County Property Taxes Bronx County Tax Information How are Property Taxes Calculated in Bronx County? Property taxes in Bronx County, New York are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.99% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/newyork/bronx-county

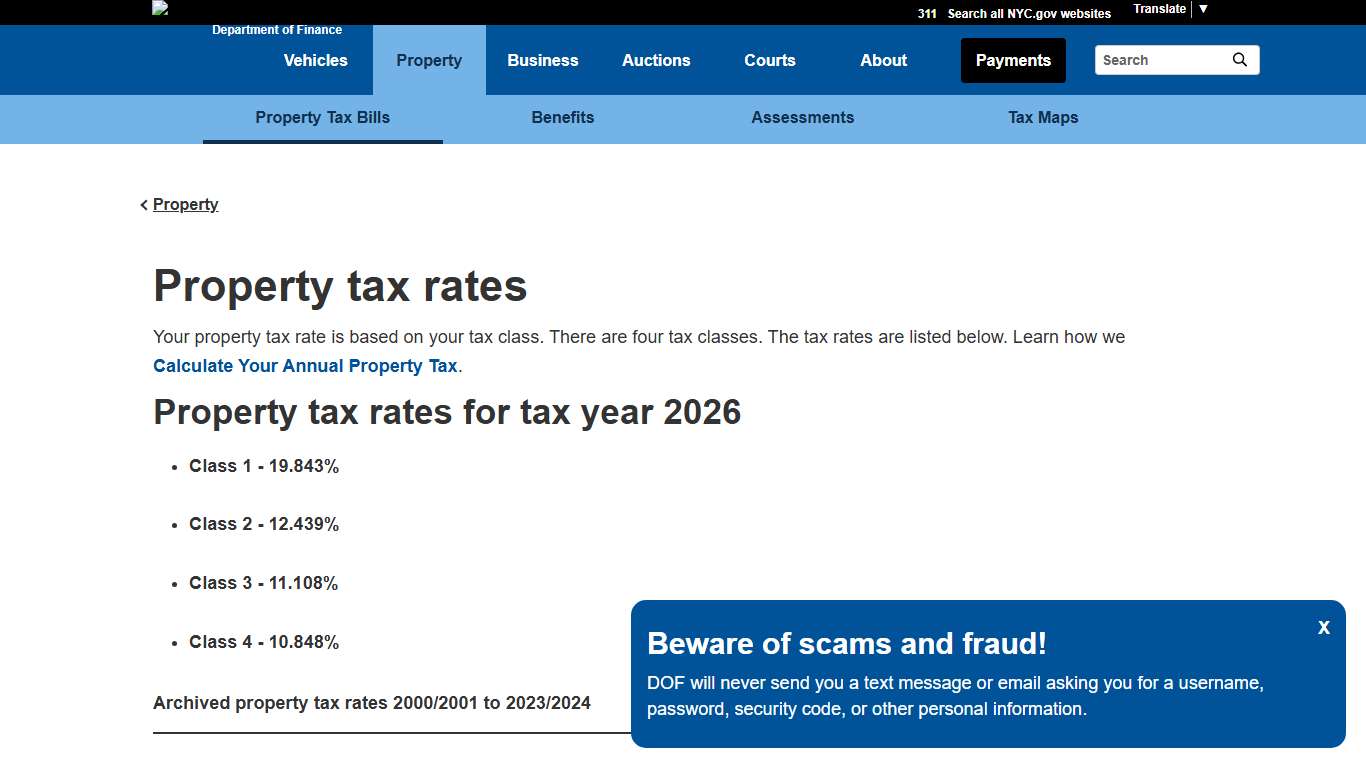

Property Tax Rates

PropertyProperty tax rates Your property tax rate is based on your tax class. There are four tax classes. The tax rates are listed below. Learn how we Calculate Your Annual Property Tax. Property tax rates for tax year 2026 - Class 1 - 19.843% - Class 2 - 12.439% - Class 3 - 11.108% - Class 4 - 10.848% School tax rates for tax years 1981-2018 Historically, school tax rates...

https://www.nyc.gov/site/finance/property/property-tax-rates.page

Personal property appraisers near Bronx, NY

Find a Personal Property Appraiser ... NY · Bronx. Personal Property Appraisal. Personal property appraisers near Bronx, NY ... Thumbtack, Inc. Thumbtack ...

https://www.thumbtack.com/ny/bronx/personal-property-appraisalA First Look at the Tax Provisions of the New York State ...

The upper tax brackets of 9.65%, 10.3%, and 10.9% will remain unchanged for 2026. New York City Personal Income Tax Eliminated for Certain ...

https://www.cpajournal.com/2026/01/23/a-first-look-at-the-tax-provisions-of-the-new-york-state-2025-2026-budget/Department of Taxation and Finance

Department of Taxation and Finance Did you experience big life changes in 2025? If you got married, had a baby, or experienced other big life changes in 2025, share the good news with us and your employer using Form IT-2104, Employee’s Withholding Allowance Certificate (instructions).

https://www.tax.ny.gov/

2026 Bronx County Sales Tax Rate - Avalara

*Rates are rounded to the nearest hundredth. Due to varying local sales tax rates, we strongly recommend our lookup and calculator tools on this page for the most accurate rates. Bronx sales tax details The minimum combined 2026 sales tax rate for Bronx, New York is 8.88%.

https://www.avalara.com/taxrates/en/state-rates/new-york/counties/bronx-county.html

2026 Colden Ave, Bronx, NY 10462 - Owner, Sales, Taxes

2026 Colden Avenue, Bronx, NY 10462 Property Information 2026 Colden Avenue, Bronx, NY 10462 Property Information - General - Owner - Documents - Tax - Permits - Neighborhood Address Lot & Building Information for 2026 Colden Avenue, Bronx Zoning & Use for 2026 Colden Avenue, Bronx Other Property Data for 2026 Colden Avenue, Bronx New York property reports include comprehensive occupancy, development and violation information.

https://www.propertyshark.com/mason/Property/82692/2026-Colden-Ave-Bronx-NY-10462/

Department of Taxation and Finance

Department of Taxation and Finance Did you experience big life changes in 2025? If you got married, had a baby, or experienced other big life changes in 2025, share the good news with us and your employer using Form IT-2104, Employee’s Withholding Allowance Certificate (instructions).

https://www.tax.ny.gov/

Never miss a post from bxcommunityboard2Sign up for Instagram to stay in the loop.

https://www.instagram.com/p/DT02H4bEbcA/

Fair Market Rents (40th PERCENTILE RENTS) HUD USER

HUD’s Office of Policy Development and Research (PD&R) is pleased to announce that Fair Market Rents and Income Limits data are now available via an application programming interface (API). With this API, developers can easily access and customize Fair Market Rents and Income Limits data for use in existing applications or to create new applications.

https://www.huduser.gov/portal/datasets/fmr.html